The continuous rise in the average price of goods and services, known as inflation, may have significant negative effects on the economy and society. Like many other nations, India has undergone increasing inflationary periods that can reduce buying power, interfere with financial planning, and impede economic progress. This problem has to be solved using a multidimensional strategy that includes both short-term fixes and long-term structural changes. In this essay, we examine the factors contributing to India’s growing inflation and provide practical solutions.

The worldwide issue of inflation is a significant one. Over the past three years, the global economy has seen a number of setbacks. The issue of inflation is not unique to India. Actually, one of the last nations in the world to experience the strain of rising costs is India. While the economies of a number of affluent nations were being hammered, India was spared any form of catastrophe related to rising living costs.

An emerging large economy like India must experience some setbacks while the global economy is under stress. The escalating conflict in Ukraine has brought the world economy to a precipice. Both the American and European economies, which are the two largest in the world, battled to contain extraordinary inflation rates. Due to historical inflation rates, entire nations had cost-of-living problems.

India did not experience such a hardship. India made the pragmatic decision to buy Russian crude oil to combat energy inflation from the start, and this trend is still going strong today. However, as inflation increases, Indians are finally paying more at retail establishments, primarily for food products. The primary cause of rising inflation is vegetables. The real offenders are tomatoes, even among veggies. Here are some astounding figures:

In July, tomato prices increased by 234 percent from one month to the next. Meanwhile, the cost of onions has increased by around 11.7% since last year. Rice is now 13% more expensive than it was previously. India’s annual retail inflation inched up to its highest level in 15 months in July. In June, retail inflation was 4.9%; however, in July, it increased to 7.4%. For the first time in five months, the statistics exceeded the top bound of the RBI’s inflation range of 2 to 6 percent.

So, there have been alarming signals. India is undoubtedly experiencing a surge in inflation. Thankfully, the government has adopted a number of measures to reduce inflation and has been aggressive on this front.

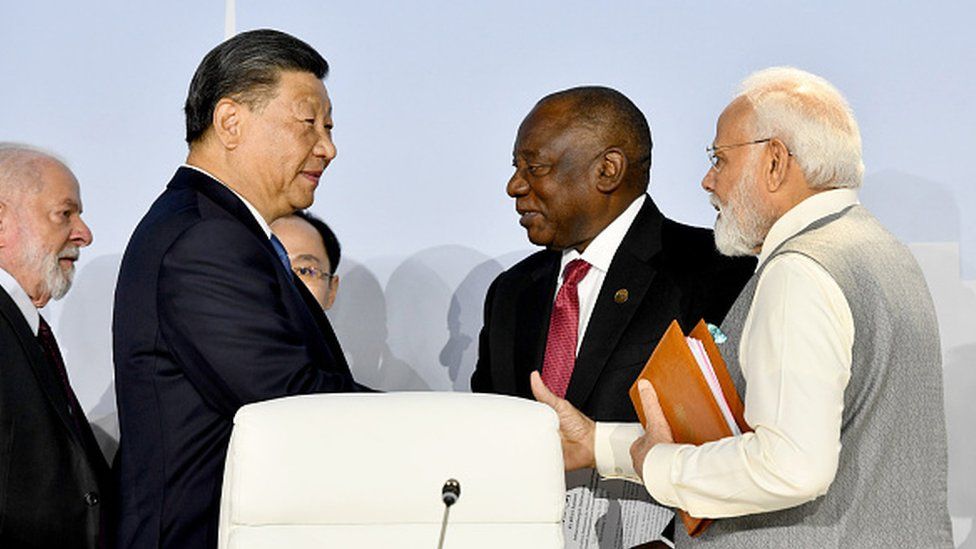

Recognising a problem’s existence is the first step towards solving it. On July 4, Prime Minister Narendra Modi carried out the action. He said that India is making every effort to keep inflation under control and that there have been “some successes” thus far. The timing is not right for complacency, he continued. The Prime Minister’s assertion that “I have to take more steps in this direction to minimise the burden of inflation on my countrymen” was the focus of the speech. And we’ll keep moving in that direction. My initiatives will not stop.

Let’s first comprehend what is behind this recent rise in inflation. Yes, rising prices for vegetables and grains play a role. But why have their prices increased? You see, the irregular weather is putting a strain on supply. The start of the monsoon season has resulted in significant floods throughout most of North India. The country’s temperatures increased in March and April, even before the monsoon season started. Farmers thus had to contend with the threat of bugs damaging their harvests. Many farmers abandoned their crops as a result, particularly tomatoes. Due to the supply stress brought on by this, prices shot through the roof during the previous two months.

As the Kharif tomato crop enters the marketplace, Indians may anticipate a decline in tomato prices shortly. The government has implemented a number of measures to control inflation since it is not just tomatoes that are a cause for concern. In addition to prohibiting the export of any rice other than basmati, this also covers its choice to import tur dal. In addition, the Modi administration has made the decision to distribute 25 lakh metric tonnes of rice and 50 lakh metric tonnes of wheat through online auctions in accordance with the Open Market Sale Scheme. India will also lower the import duty on wheat in order to increase supplies.

Globally, interest rate increases were swiftly implemented by the central banks of several nations to combat inflation. However, the Reserve Bank of India (RBI) is holding off. Unless headline inflation exceeds 6% for two consecutive quarters, the RBI is unlikely to boost interest rates. That is a practical course of action to adopt given that India does not want high interest rates to hinder economic development, even if the ultimate objective is to reduce inflation.

India’s commercial banks have plenty of cash. Any nation must cut back on systemic liquidity in order to fight inflation. And the RBI is not raising interest rates in the process. All banks must uphold an incremental cash reserve ratio (ICRR) of 10%, per its directive. The percentage of assets that banks must maintain as deposits with the RBI is known as the CRR. According to the RBI, this action will remove excess liquidity of Rs 1 lakh crore from the economy.

What’s on the line? A lot. Inflation is one issue that the Indian electorate abhors. Price increases have historically alienated Indians virtually invariably, and whole administrations have lamented not taking action quickly enough to control inflation. A critical year is ahead for the Modi administration. First, later this year, elections will be held in numerous states. Modi has made it very apparent that he will run for re-election as prime minister at the beginning of the following year.

This indicates that the BJP-led administration wants everyone to pitch in. There can be no room for chance. The BJP cannot afford to lose the upcoming elections because of price increases. India is viewed as a shining light amid a generally gloomy economic landscape. According to the International Monetary Fund (IMF), the Indian economy will expand by 6.1% in the next fiscal year. However, inflation can cause trouble. The RBI will have no choice but to boost interest rates if inflation spirals out of control. India’s GDP growth rate would surely suffer as a result of this. India is making progress towards its ambition to soon have a $5 trillion economy. In his third term, Prime Minister Modi has pledged to make India the third-largest economy in the world. It goes without saying that the administration is aware of the seriousness of the inflation danger.

It would be premature to come across as hopeless and dejected right now. This year’s price increases were influenced by transient variables. These issues have largely been resolved. India has restricted the export of rice, despite the fact that many people do not understand why. In reality, the Modi administration itself imposed an embargo on wheat exports last year. This demonstrates that the Centre has been monitoring all inflationary trends and has taken fast action whenever it has detected a warning sign. The inflation statistics could have been scarier if they hadn’t. To increase local supply and reduce prices, India is also considering buying wheat from Russia. It’s all hands on deck, like I stated.

Although the most recent inflation figures are alarming, they do not necessarily indicate that the Indian economy is in trouble on a macroeconomic level. Call these figures seasonal since it won’t be long before they begin to stabilise. Having said that, this is not the time for complacency, as Prime Minister Modi stated. There is still more to be done to combat inflation, which is a major problem.

The economic health of India and the well-being of its people are seriously threatened by rising inflation. A mix of short-term tactics to control current pressures and long-term structural reforms to improve supply capabilities and overall economic resilience are needed to address this challenge. Working together to execute policies that strike a balance between reining in inflation and promoting sustainable economic development is crucial for politicians, corporations, and individuals. By implementing these actions, India may seek to achieve price stability, protect its people’s buying power, and provide an atmosphere that is favourable for economic success.