On Thursday, March 20, 2025, the rupee stayed strong and gained 1 paisa to finish at 86.36 (provisional) against the U.S. dollar. This was due to strong domestic stocks.

Forex traders said that the Indian rupee has fought back against forces from outside the country, with strong foreign flows into debt markets helping it.

There are still risks, though, because foreign institutional investors are still selling off, and the rupee’s upward trend could be slowed down by the confusion surrounding Trump’s tariff policy.

When trading between banks, the rupee started the day at 86.39 against the dollar and hit a high point of 86.20 and a low point of 86.41. The unit finished the session at 86.36 (provisional) against the dollar, up 1 paisa from when it started the session.

To end the day on March 19, 2025, at 86.37, the rupee was worth 19 paise more than the U.S. dollar.

This is the fifth day in a row that the rupee has gone up. It has gained 87 paise.

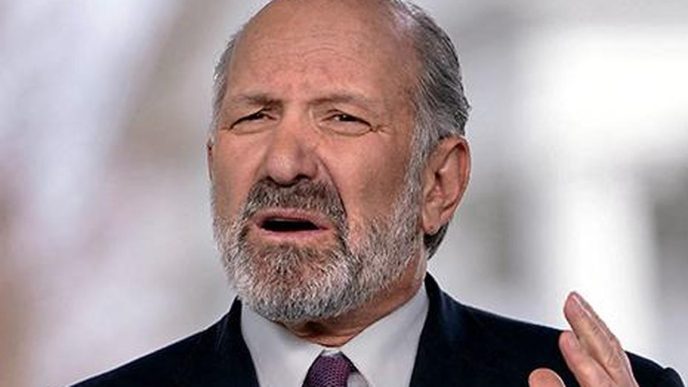

Forex traders also said that Jerome Powell, the chair of the Federal Reserve, has made it clear that the U.S. central bank is ready to keep rates high if inflation stays stubborn. Powell’s cautious stance suggests that rate cuts are on the horizon, but the Fed will remain data-dependent, which leaves room for surprises.

The dollar index, which measures how strong the dollar is against a group of six other currencies, was trading 0.46% higher at 103.90.

The world standard for oil, Brent crude, went up 0.10% to $70.85 per barrel in futures trade.

The 30-share BSE Sensex rose 899.01 points, or 1.19%, to end the day at 76,348.06 points, and the Nifty rose 283.05 points, or 1.24%, to end the day at 23,190.65 points.

According to statistics from the exchange, foreign institutional investors (FIIs) sold stocks worth a net of ₹1,096.50 crore on March 19, 2025.

The RBI March Bulletin, which came out on March 19, 2025, said that strong fiscal policies, a well-tuned monetary framework, and digital transformation efforts should create a solid base for long-term, stable economic growth.

Also, it said that the big picture of the economy is still strong, and that growth is likely to keep going thanks to strong demand at home, steady investment activity, ongoing policy-driven infrastructure development, and more spending by the government.