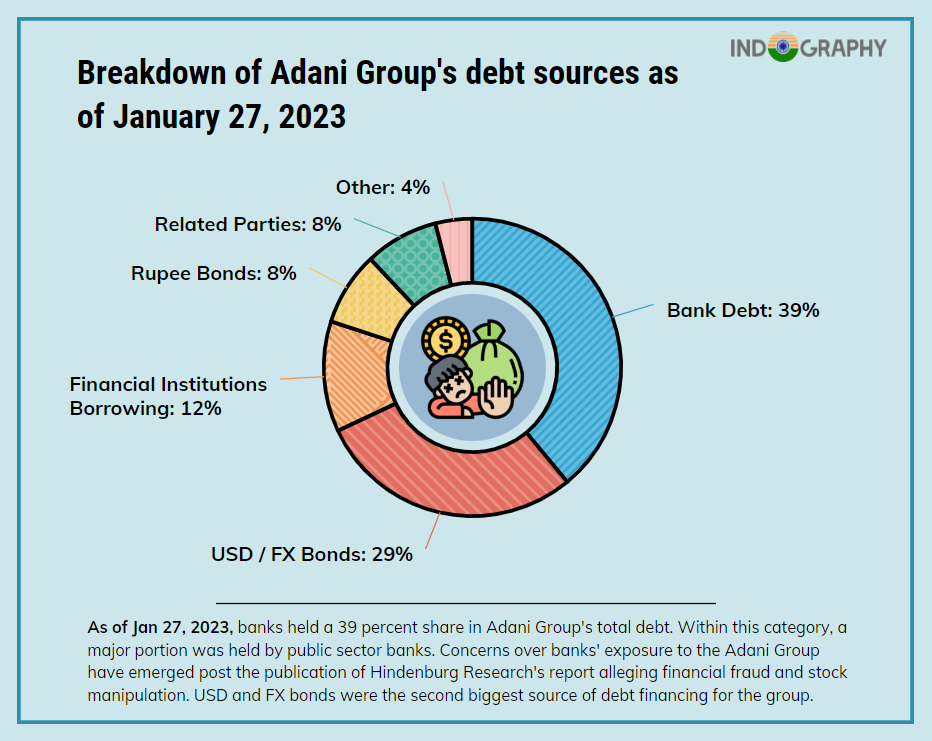

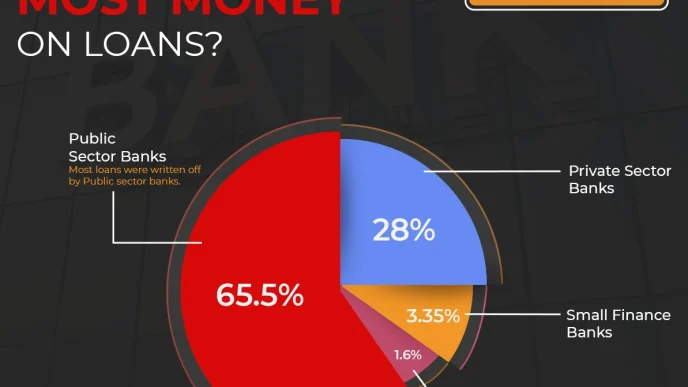

Banks hold a significant share in Adani Group’s total debt, accounting for 39 percent as of January 27, 2023. Public sector banks hold a major portion of this debt. However, concerns have emerged over banks’ exposure to the Adani Group following the publication of a report by Hindenburg Research that alleged financial fraud and stock manipulation.

The Adani Group is one of India’s largest conglomerates with interests in a wide range of industries including ports, logistics, energy, and mining. The group has been expanding rapidly in recent years and has become a major player in India’s economy.

However, the recent report by Hindenburg Research has raised questions about the Adani Group’s financial practices. The report alleged that the group inflated the value of its assets and engaged in stock manipulation. The report also claimed that the group used offshore entities to evade taxes and that its subsidiaries had high levels of debt.

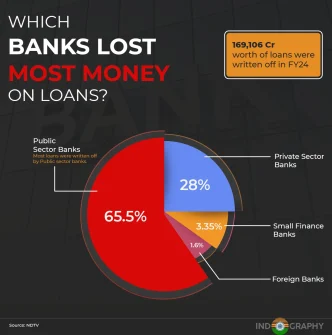

These allegations have caused concern among investors and creditors, particularly those who hold Adani Group debt. Banks, in particular, are exposed to the group’s debt, with public sector banks holding a significant portion of it.

The Adani Group has denied the allegations made in the report, calling them “blatantly erroneous”. The group has stated that it follows all applicable laws and regulations and that its financial statements are audited by reputable firms.

Despite these denials, the allegations have had an impact on the Adani Group’s stock prices and its ability to raise funds. The group’s shares fell sharply following the publication of the report, and several global investors have reportedly divested from the group’s companies.

The Adani Group has also faced opposition from environmental and social activists who have raised concerns about the group’s impact on local communities and the environment. The group has been involved in controversial projects such as the Carmichael coal mine in Australia, which has faced opposition from environmental groups.

In conclusion, the Adani Group’s debt and its exposure to banks have come under scrutiny following allegations of financial fraud and stock manipulation. While the group has denied these allegations, they have had an impact on the group’s reputation and its ability to raise funds. The Adani Group’s future will depend on how it addresses these concerns and whether it can regain the trust of investors and creditors.